PLANNED

GIVING

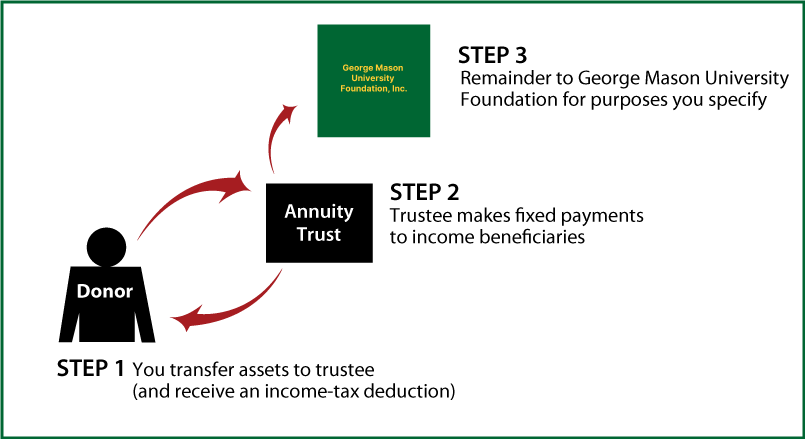

Making a planned gift is a wonderful way to show your support and appreciation for George Mason University and its mission while accommodating your own personal, financial, estate-planning, and philanthropic goals.

Making a planned gift is a wonderful way to show your support and appreciation for George Mason University and its mission while accommodating your own personal, financial, estate-planning, and philanthropic goals.

Request an eBrochure

Request Calculation

Contact Us

|

Aquanetta J. Betts, JD |

George Mason University Foundation, Inc. |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer