PLANNED

GIVING

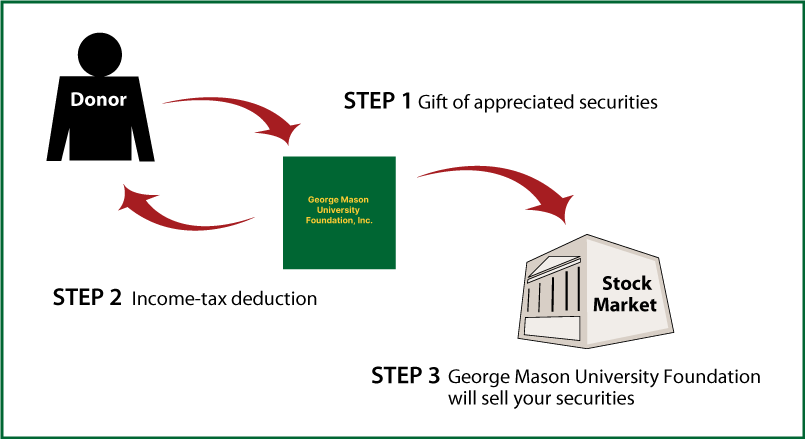

Making a planned gift is a wonderful way to show your support and appreciation for George Mason University and its mission while accommodating your own personal, financial, estate-planning, and philanthropic goals.

Making a planned gift is a wonderful way to show your support and appreciation for George Mason University and its mission while accommodating your own personal, financial, estate-planning, and philanthropic goals.

Special note: You should call or e-mail us to tell us of your intent, and we will be able to assist you with the details of the transfer.

Request an eBrochure

Which Gift Is Right for You?

Contact Us

|

Aquanetta J. Betts, JD |

George Mason University Foundation, Inc. |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer